Crypto Dystopia: Examining Risks and Challenges in Digital Asset Trading

In the ever-evolving landscape of the financial world, digital assets have emerged as a revolutionary force, challenging traditional notions of currency and investment. The rise of cryptocurrencies, epitomized by Bitcoin and Ethereum, has sparked a new era of financial innovation. However, beneath the surface of this digital utopia, a complex web of risks and challenges lurks, shaping the narrative of a potential crypto dystopia.

The Allure of quotex: Navigating the Cryptocurrency Landscape

The allure of cryptocurrency trading is often encapsulated by the promise of quotex. Investors, both novice and seasoned, are drawn to the potential for significant returns in this decentralized realm. The quotex factor, representing the elusive element of unpredictability, is both a boon and a bane. While it fuels excitement and speculative fervor, it also introduces a level of risk that demands careful consideration.

Regulatory Tightrope: Balancing Innovation and Oversight

As the crypto market expands, regulators face the formidable task of walking a tightrope between fostering innovation and safeguarding investors. The decentralized nature of cryptocurrencies poses a challenge for traditional regulatory frameworks. The absence of a central authority raises questions about investor protection, market manipulation, and the prevention of illicit activities. Striking the right balance is crucial for the long-term viability of digital asset trading.

Security Breaches: The Achilles Heel of Cryptocurrencies

Cryptocurrencies, touted for their robust blockchain technology, are not immune to security breaches. High-profile hacks and breaches have highlighted the vulnerability of digital assets to malicious actors. From exchanges to individual wallets, the threat landscape is diverse and ever-evolving. Investors must navigate this perilous terrain with caution, adopting robust security measures to protect their holdings from the specter of cyber threats.

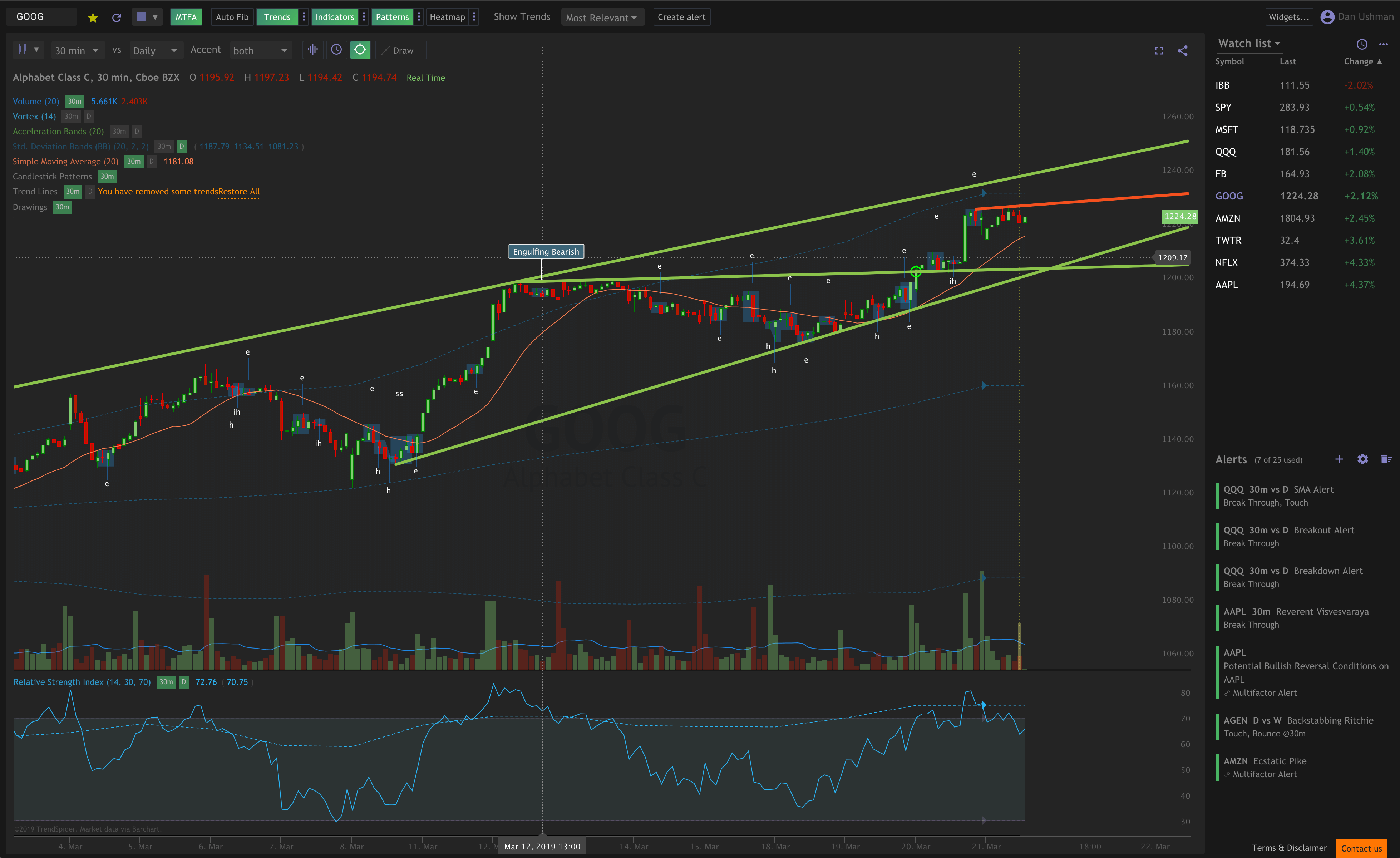

Volatility Unleashed: Riding the Crypto Rollercoaster

Volatility is the beating heart of the cryptocurrency market, driving exhilarating highs and gut-wrenching lows. The quotex factor, mentioned earlier, plays a pivotal role in amplifying this volatility. While some thrive on the adrenaline of market fluctuations, others find themselves at the mercy of unpredictable price swings. Understanding and managing volatility becomes imperative for those venturing into the realm of digital asset trading.

The Decentralization Paradox: Freedom vs. Responsibility

Decentralization, a core tenet of cryptocurrencies, is a double-edged sword. While it offers freedom from traditional financial institutions and intermediaries, it also places the onus of responsibility squarely on the individual. The absence of a centralized authority means there’s no safety net to fall back on in case of mistakes or unforeseen circumstances. Empowering individuals comes with the inherent challenge of ensuring they are equipped to navigate the complexities of financial decision-making.

Market Sentiment: The Echo Chamber of Speculation

In the digital age, information travels at the speed of light, influencing market sentiment in real-time. Social media platforms and online forums serve as echo chambers of speculation, where a single tweet or post can send ripples through the market. Navigating the sea of information requires discernment, as hype and misinformation can distort perceptions and lead to impulsive decision-making.

Future Uncertainties: Adapting to the Evolution of Cryptocurrencies

The future of digital asset trading is shrouded in uncertainties. Technological advancements, regulatory developments, and market dynamics are constantly in flux. As the crypto landscape evolves, adaptability becomes a key survival trait. Investors and stakeholders must stay vigilant, embracing change and staying abreast of developments to thrive in this dynamic ecosystem.

In Conclusion: Navigating the Dystopian Landscape of Cryptocurrency

As we navigate the ever-shifting landscape of digital asset trading, the quotex factor remains a constant companion. While the allure of potential gains is undeniable, the risks and challenges paint a nuanced picture of a crypto dystopia. The path forward demands a delicate balance of innovation, regulation, and individual responsibility. In the quest for financial revolution, the true test lies in our ability to navigate the dystopian undercurrents and emerge unscathed.